Optimize reach across channels with our self-service solutions, featuring high-fidelity B2B data and custom audiences.

Resources

Discover these B2B marketing tips, trends, stories, and actionable guides

Unleashing Growth: What B2B Marketers Are Doing to Stay Ahead

Industry Insights

Expert exchange on optimizing B2B marketing with Generative AI

Artificial Intelligence

6 takeaways from the 2023 Forrester B2B Summit

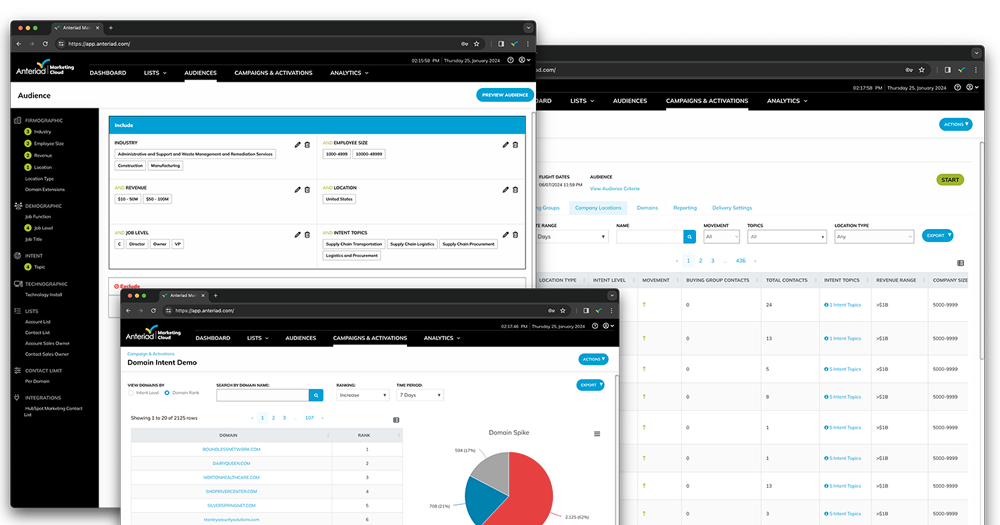

Intent Data

Full Funnel Marketing

Buying Groups

3 Questions to Ask When Setting Your Marketing Budget for 2023

Data Strategy

Industry insights

Demand Gen Report: The Importance Of Accuracy, Truth & Transparency In Intent Data

Intent Data

Sorry, no results found. You can clear the filters or try a different search term.

.png)

.png)