The 2023 Marketing Data Impact Report: B2B Marketers Under Pressure to Prove It or Pull Their Hair Out

- Introduction

- Key Highlights

- The impact of using the right data to build and convert audiences

- Where are marketers able to prove value?

- What factors contribute to improving metrics?

- The impact of high-quality data

- Using data effectively

- The rise of intent data

- Access and management of intent data

- Next steps

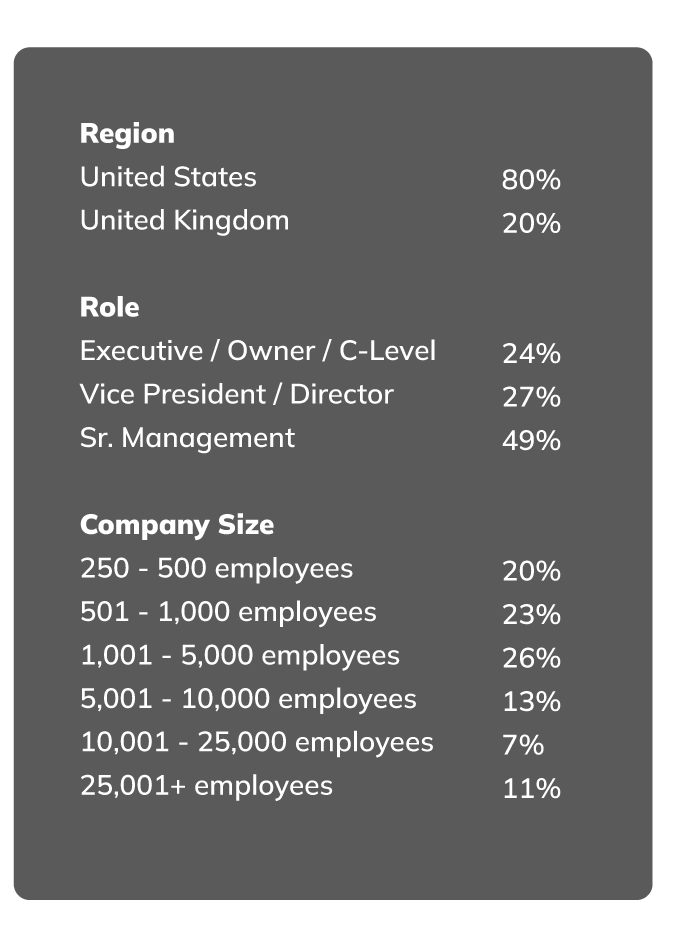

- Methodology

Is proving the value of your marketing efforts making you want to pull your hair out?

Your peers feel it too.

When we asked marketers about their goals and their data strategies, we learned about the challenges they’re facing — like tight budgets — and discovered opportunities to support growth from those who are finding success. The right data makes a big difference. This data must be accurate, accessible, and in a format you can work with. It’s the difference between outperforming your goals or not being able to rise to the mounting pressure.

We know the importance of having a comprehensive data strategy from our 2022 research study The 2022 Outlook on Data and Technology: A Year of Herding Cats and Black Holes. This year, Anteriad partnered with the research firm Ascend2 again to survey 328 B2B marketing leaders at mid-market and enterprise companies in the United States and the United Kingdom to build on last year’s insights and dig deeper into how marketers are using data to build and convert audiences.

Key Highlights

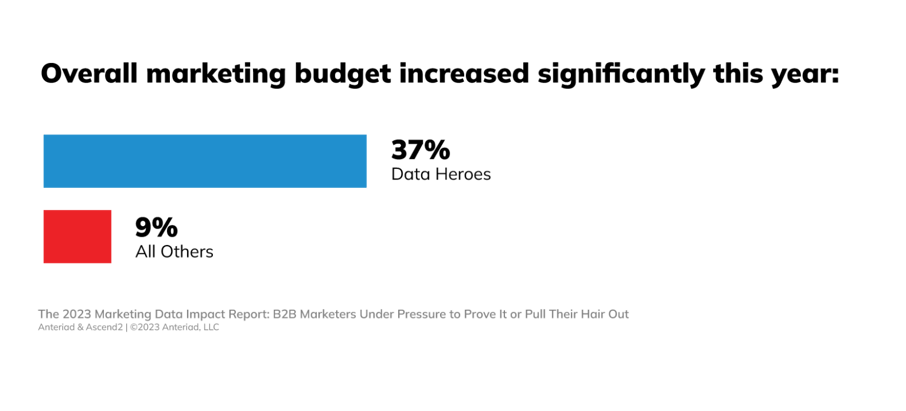

Pressure is increasing, but budgets are not.

41% of marketers say that the pressure to prove the value of overall marketing efforts is high (27% report it’s getting overwhelming and 14% say it makes them want to pull their hair out). While facing growing pressure, they aren’t seeing increased resources to support their efforts—only 16% of those surveyed saw a significant increase in their marketing budget for this year. On top of that, marketers are facing challenges hitting lofty goals. Less than one-third of marketers surveyed feel that it is very likely that next quarter’s goals will be met.

With better data, marketers can expect better results and more revenue.

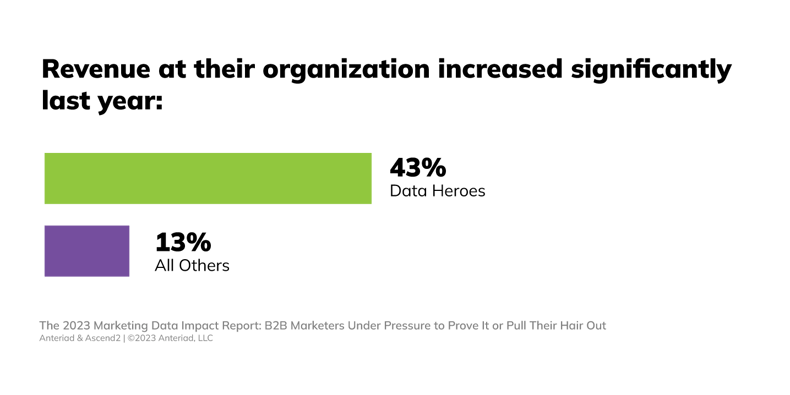

43% of marketers who report they are using the right data to target their audience saw a significant increase in revenue last year compared to just 13% of those who feel less confident that they are using the right data. These marketers can prove they have the right data based on the leads generated in their pipeline.

Intent data leads are more powerful — as proven in pipeline and revenue.

97% of those surveyed say that intent data leads drive more pipeline than non-intent data leads and 86% agree that intent data leads increase Marketing Qualified Lead (MQL) to Sales Accepted Lead (SAL) conversions more than non-intent data leads. Additionally, intent data use is linked to revenue growth. Those who saw a significant increase in revenue last year are more likely to be using intent data than those who did not see a significant increase in revenue last year.

The impact of using the right data to build and convert audiences

How marketers build and convert audiences has major impact on business outcomes. Building an audience is a foundational step in all your marketing efforts. To effectively build audiences that will convert, you need a solid base of data.

Marketers who report using the “right” data for their business are more confident in their data and results, saw a better rate of improvement in metrics and revenue in the last year, and use their data for more advanced use cases than their peers.

Introducing the Data Heroes.

The 27% of marketers that reported they are utilizing the right data to convert audiences, as proven in their pipeline, are our “Data Heroes.”

What sets the Data Heroes apart from their peers?

- Increased revenue: Data Heroes saw larger revenue growth in 2022 compared to their peers. In fact, they reported a significant increase in revenue 3x as much as the rest of the surveyed marketers.

- Increased budgets: Marketing budgets aren’t as much of a challenge for the Data Heroes. While nearly half of their peers reported their budgets stayed the same or decreased, 78% of Data Heroes saw an increase in budget this year: 4x as many Data Heroes reported a significant increase in budget over the other survey.

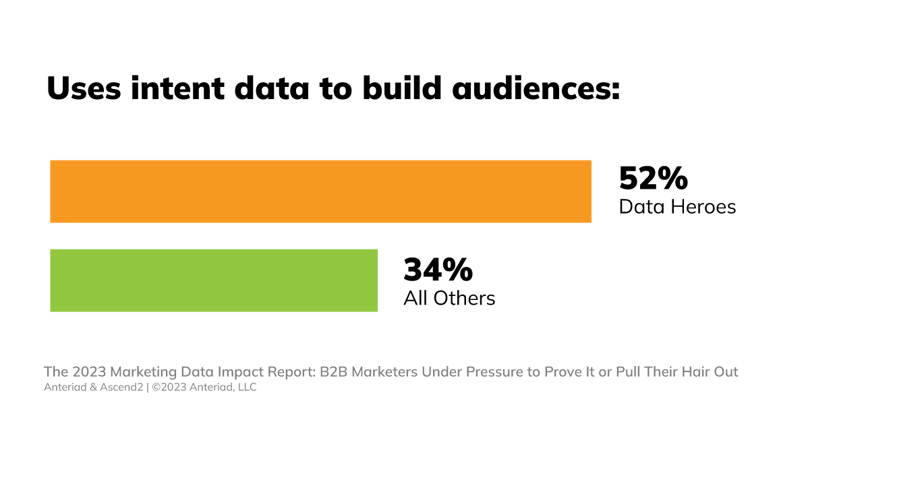

- Intent data: Data Heroes are significantly more likely to be using intent data to build an audience than the rest of their peers.

Where are marketers able to prove value?

Marketers are facing heightened pressure to prove they’re driving value. We found that 41% of marketers feel that pressure is overwhelming—with 14% of those respondents saying the pressure is so high it makes them want to pull their hair out.

With most reporting no significant increase (or in 19% of cases, a decrease) in budget, marketers must be strategic about how to make the most impact without breaking the bank. The good news is that more than half of marketers (56%) feel like they can prove the value of their efforts.

Nearly half (46%) also reported they can prove the quality of the leads they are bringing in, and 40% say they are able to prove the value of marketing-influenced pipeline and revenue.

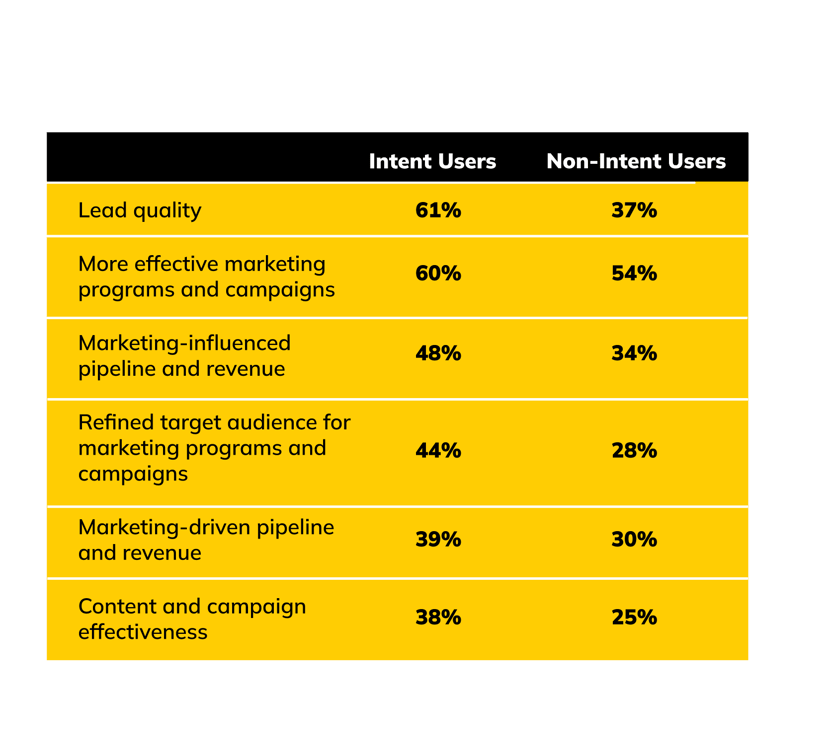

Intent users can prove more value.

Those who are using intent data feel significantly more able to prove the value of their work across the board to decision-makers. This shows that the marketers who are using intent data have an advantage over their peers. They’re equipping themselves with tools that drive more value and make their jobs easier. If you aren’t already using intent data, consider adding it to your data strategy.

Tracking performance.

When we asked how marketers track their performance, we found that the responses were evenly mixed across the board between automated and manual tracking—but marketers who use automation to track performance feel better equipped to prove their value. Using automation builds confidence that reporting is being done correctly and consistently.

One-quarter (25%) of marketers say they are still tracking performance manually and another 25% are using automation. The rest report using a combination of both manual and automated tracking.

What factors contribute to improving metrics?

Marketers are always looking for ways to improve their metrics, but with current pressure to prove impact, it’s more important than ever. Many factors contribute to whether or not marketers are seeing improvement. The three primary factors that led to improving metrics were using the right data, leveraging intent data, and targeting buying groups.

1. Using the right data.

Data is key, but the right data is what really makes an impact. Using the right data has a significant impact on metrics, according to our research. The right data isn’t the same for every organization. The right data goes deeper than the type of data (such as firmographic or behavioral) to how you use data, how you access and store your data, your confidence in your data providers, and ultimately to the quality of the leads and pipeline generated. Our Data Heroes group saw greater improvement in metrics such as click-through rates, campaign conversion, sales pipeline generated, lead-to-customer conversion, lead velocity, and cost per lead in the last year than those who don’t feel as strongly that they are using the right data.

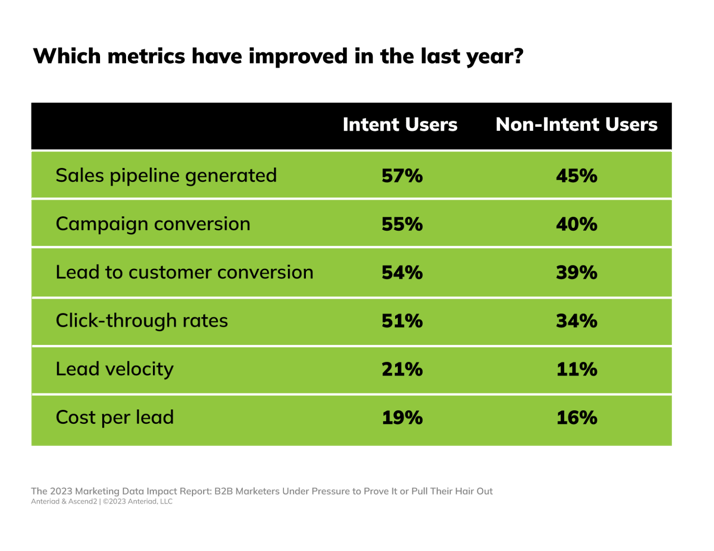

2. Using intent data

Intent users saw significantly greater improvement in metrics last year. Across all key metrics included in the research, we found that intent data users saw better results — from increased pipeline to the ability to prove the value of their efforts. Though it is only currently being used by 38% of marketers for targeting, those taking advantage of it are being rewarded in performance. Even the marketers who aren’t using intent data recognize its value.

86% of marketers surveyed agree that intent data leads increased MQL to SAL conversions more than non-intent data leads.

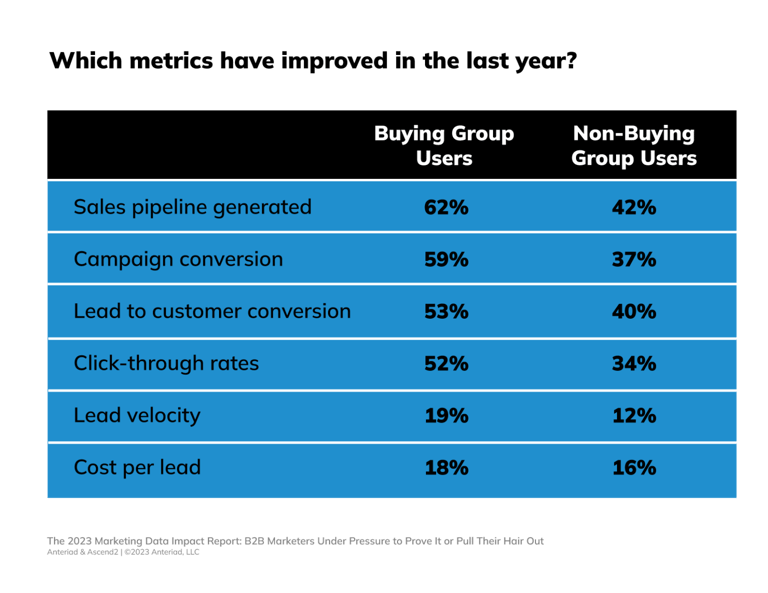

3. Scoring by buying groups

Marketers who report that they use buying groups as a scoring element in their marketing programs also saw more improvement in metrics last year than those who do not. Using buying groups means tracking the collection of individuals involved in the buying process instead of just one person.

The impact of high-quality data

The data marketers are using has a high impact on the results they’re seeing. Those who are confident they have the right data are seeing a direct impact—more revenue. How they acquire high-quality data and how they use it across their efforts play a role in the results they deliver.

How are organizations collecting data?

How marketers collect data is pretty mixed, with many marketers using more than one source to acquire data. Most marketers use their own properties and/or access audience-building and lead selector tools through a data platform. These are relatively basic data acquisition tactics. A smaller portion of the survey respondents are purchasing standalone data to use internally. Buying standalone data means you are strictly purchasing the information but not contracting any services to use that data. This method relies heavily on internal tools and technology whereas other strategies lean more on the data provider for building and converting audiences.

All these methods have their place, and it may not make sense for all organizations to be getting data from each source. For example, smaller organizations may not have the resources to effectively use standalone data. These answers give us insight into the landscape of how marketers approach their data use—and that some organizations may be able to optimize their data use by adjusting how they acquire it.

Second- and third-party data: benefits and challenges

Marketers are acutely aware that the data they collect needs to be of the highest quality, regardless of its source. Using second- and third-party data is a major opportunity for marketers to expand their understanding and reach of their target audiences, but it poses a unique set of challenges. When it comes to outsourced data (second- and third-party data), the areas that marketers find most important are also their greatest challenges.

Marketers recognize that working with a reputable data partner is key to their business. Data accuracy is by far the most important factor when it comes to choosing data providers at 62%. Other important factors include proven results and data privacy/compliance. Data is the foundation of every marketing effort—and marketers realize the information needs to be sound.

Even though quality is of the utmost importance to marketers, this is often where they face challenges with outsourced data. The top two challenges associated with second- and third-party data are data quality and completeness and finding trusted sources.

You can address these data quality challenges by working with data providers who have received third-party certifications like Neutronian, SOC2, ICO, Privacy Shield, and OneTrust.

When it comes to choosing a partner, our Data Heroes group values many of the same factors as the rest of the marketers surveyed. But perhaps the most interesting finding is that they don’t care nearly as much about a partner’s proven results. They do, however, care twice as much about the breadth of topics a partner can provide. This is probably because they’re already seeing results and they’re confident they can replicate and build on these results given the right data.

Using data effectively

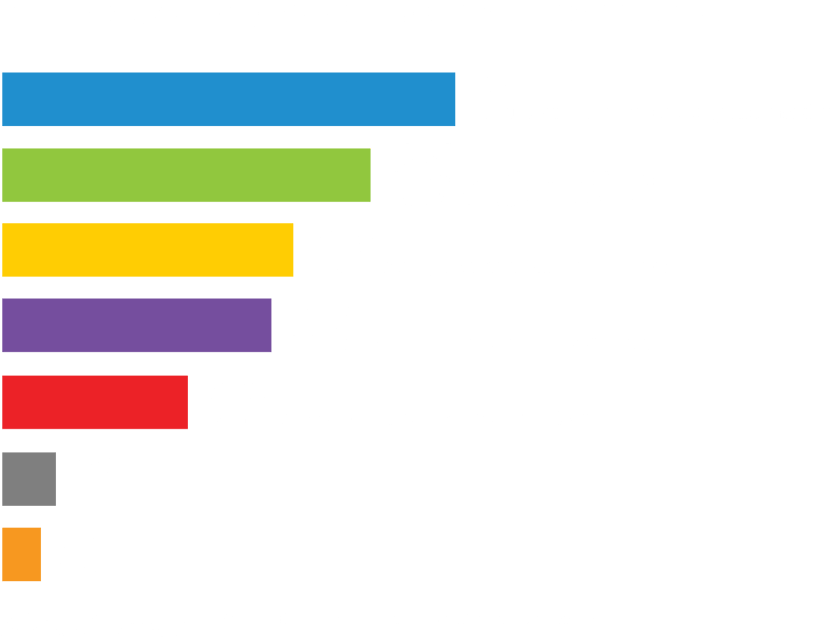

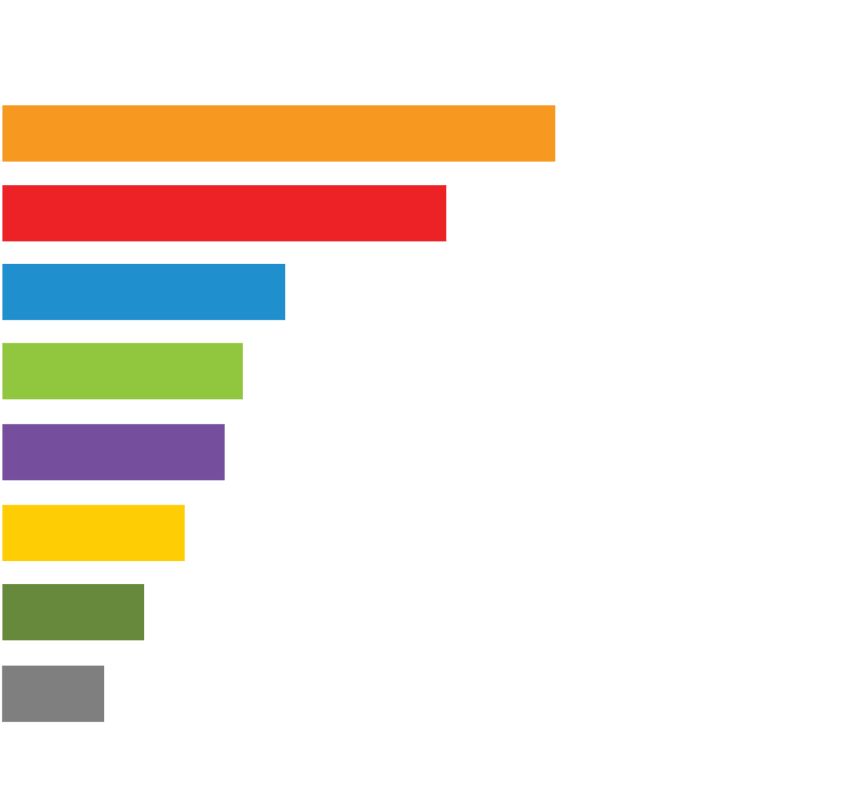

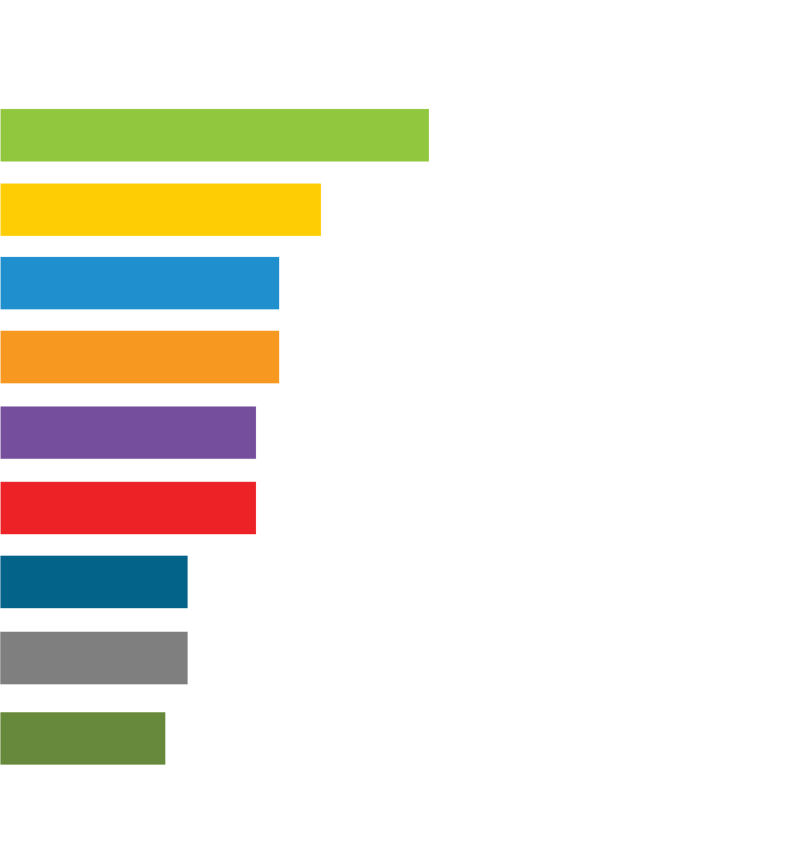

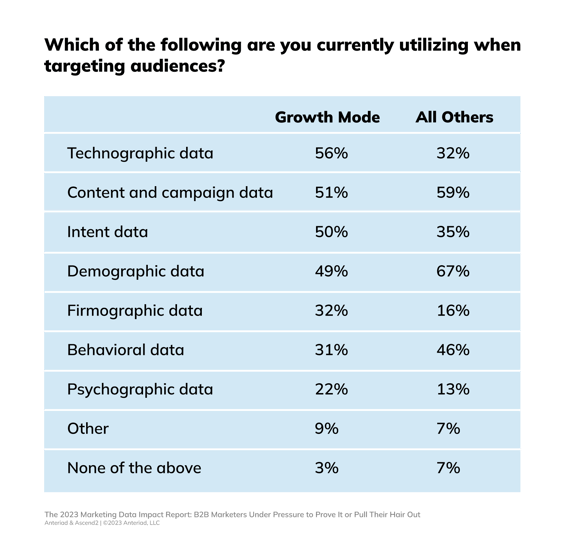

Types of data used

When it comes to the types of data marketers are using, we found demographics is the most commonly used data. This makes sense because most B2B marketers would use information like job titles to target audiences. It’s a bit surprising that only 19% responded that they use firmographic data since this allows you to target with information based on company information. When we look at the responses to our study it’s interesting to note that the data that is most used isn’t necessarily the most impactful for growth.

Overall, the most used data types are demographic data, content and campaign data, and behavioral data. These were also rated as the most impactful types of data for driving leads . . . but if the goal is to drive pipeline, then intent data is critical. 97% of those surveyed say that intent data leads drive more pipeline than non-intent data leads.

Intent data leads are higher quality. 94% of those surveyed agree that intent data leads are of higher quality than non-intent leads.

Since intent data is only being used by 38% of marketers to target audiences, there is a major opportunity for many marketers to layer intent into their strategy to build and convert audiences.

Our “Growth Mode” group, those who saw a significant increase in revenue last year, are more likely to be using intent data, technographic data, firmographic data, and psychographic data than those who did not see a significant increase in revenue last year. These extra targeting factors allow you to better understand your audience and reach those likely to convert. Marketers investing in quality, in-depth data are seeing the payoff.

27% of marketers surveyed report that they are using the right data to convert audiences, proven in their pipeline.

35% of those who have seen significant revenue increases in the last year say that intent data has the greatest impact on driving leads, compared to 28% of those with less revenue growth.

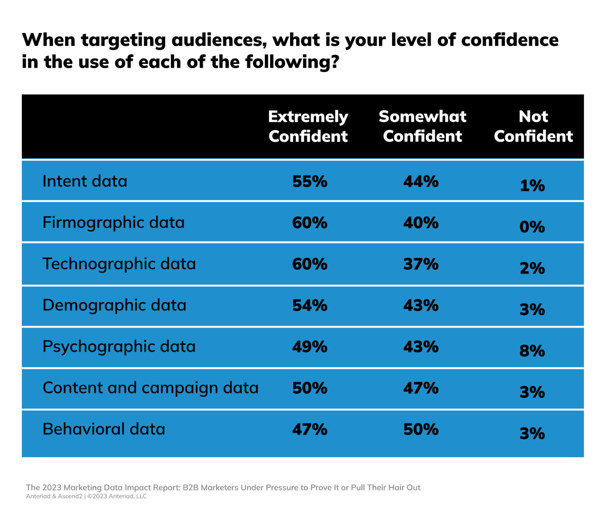

Confidence in data utilization

Even though data utilization is a big part of a marketer’s job, we found that many aren’t very confident in using different types of data to target audiences.

There is significant room for growth when it comes to confidence in data utilization. 53% of marketers using behavioral data are just somewhat or not confident in their application of it. About one-in-ten psychographic data users feel not at all confident in their use of it. This matters because having the right data is just the first step. You also must be able to leverage it effectively.

Those who saw a significant increase in revenue last year are significantly more likely than all others to be extremely confident in their intent data use.

If you aren’t confident in how to use your data, you may be missing out on valuable pipeline opportunities. To gain confidence in your strategy, it’s best to work with an experienced data provider and ask questions about best practices along the way. Another way to become more confident with your data is to run test campaigns with different audience segments and analyze results.

Data Heroes are confident in the data they use to target audiences. They show significantly higher confidence in all the data types we asked them about compared to their less confident counterparts.

These marketers are placing a heavier weight on technographic data and intent data when it comes to which data has the greatest impact on driving leads. Of Data Heroes, 38% say technographic data and 32% say intent data has the most impact on driving high-quality leads compared to just 22% and 28% respectively for the rest of the group. Since they’re more confident in these data types than the others surveyed, they’re using this data more effectively and seeing the results.

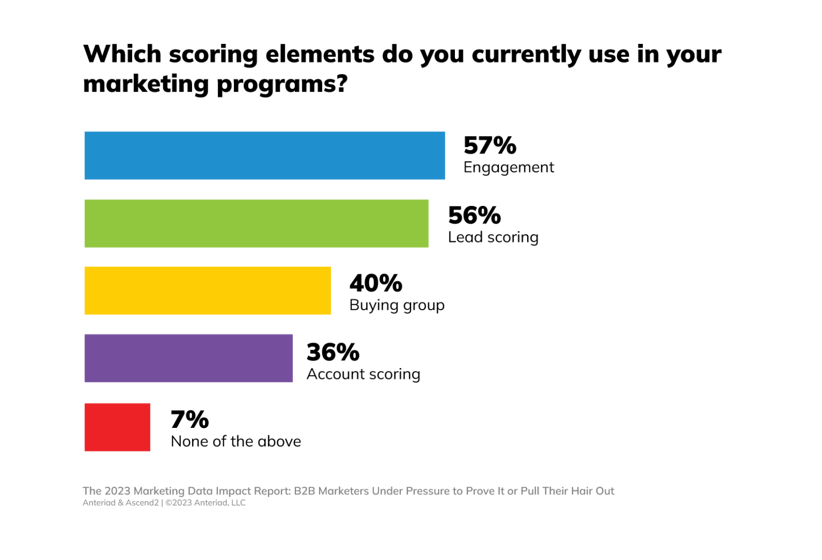

What scoring elements are being used?

Scoring elements are used to prioritize, segment, and sort your prospects. You can develop scoring based on:

- Engagement to measure which prospects are showing interest in your marketing efforts

- Lead scoring to pinpoint where a lead is in their buying journey and inform your next outreach

- Account scoring to understand buying potential and how to prioritize your marketing and sales efforts

- Buying groups to track who is part of a purchase decision and identify the key decision-makers within a target company

The most commonly used scoring elements are engagement and lead scoring, while 40% are using buying groups.

Our Data Heroes are 2x more likely to be using buying groups than those who don’t feel they are using the right data. The vast majority of this group (83%) are satisfied with their existing use of scoring elements, and none reported the need for more budget or to investigate the value of improving scoring elements. They’re driving results and they’re happy with the value they’re seeing from their current scoring process.

Based on the results our Data Heroes are seeing coupled with their heavy use of buying groups, evolving your scoring elements to include buying groups is an important consideration for improvement. Once you have buying group scoring in place, you can more accurately track and understand potential customers and improve future targeting efforts.

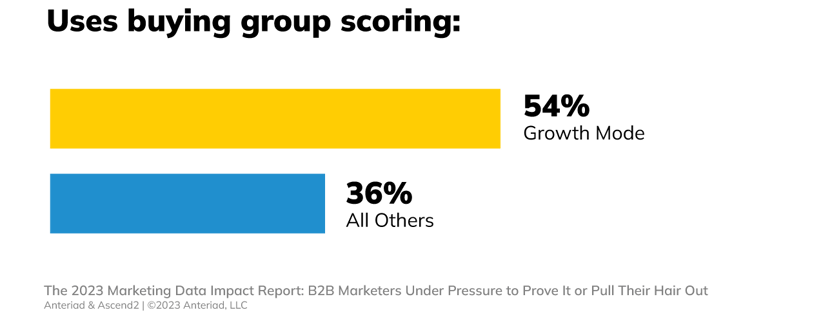

The power of the buying group

Those who are using buying groups are seeing big benefits. Marketers who reported using buying groups were significantly more confident in the data they are using. Additionally, those in the Growth Mode group were 1.5x as likely to be using buying groups.

A closer look at those using buying groups:

- Those who saw a significant increase in revenue last year are more likely to be using buying groups (54% vs 36%)

- Those who feel they are using the right data are 2x more likely to be using buying groups than those who don’t feel they are using the right data (61% vs 32%)

- Those who are using buying groups are significantly more confident in the data that they are using

What is holding marketers back from improving scoring elements?

For the organizations that are not focused on improving or increasing scoring elements, many say they are simply satisfied with their existing methodology. Another 31% feel that they don’t have enough budget. This is no surprise, as only 16% of marketing budgets saw a significant increase this year.

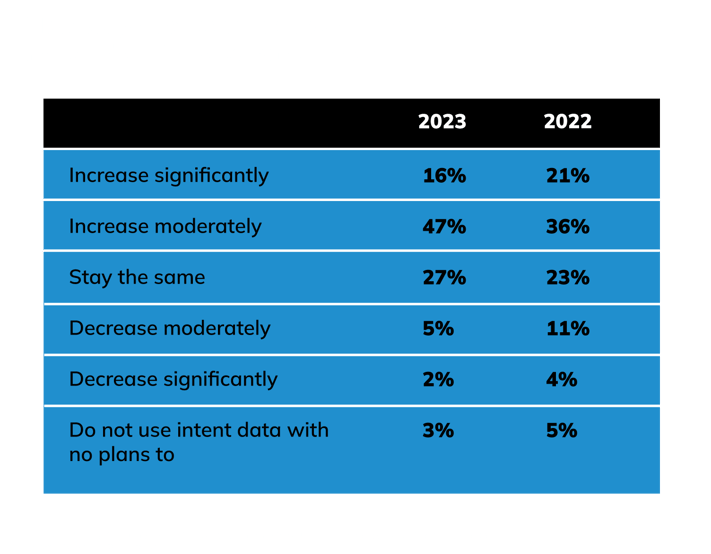

The change in use of intent data

Marketers are recognizing the power of intent data for building and converting audiences. Most of the marketers we surveyed plan on increasing their use of intent data or to start using it if they aren’t already. In fact, year-over-year marketers have reported they plan to increase their intent use.

In our 2022 study, 57% of marketers we surveyed reported that they would be increasing their use of intent data to some extent in the year ahead. Fast forward to March 2023, in our most recent survey we have 63% — nearly two-thirds — of marketers reporting an expected increase in the use of intent data in the remainder of 2023. Only 7% report they will decrease use.

Data Heroes are more likely to be using intent data—and they plan on increasing their use this year. 86% of Data Heroes plan to increase their intent data use this year—with nearly half of those expecting their use to significantly increase.

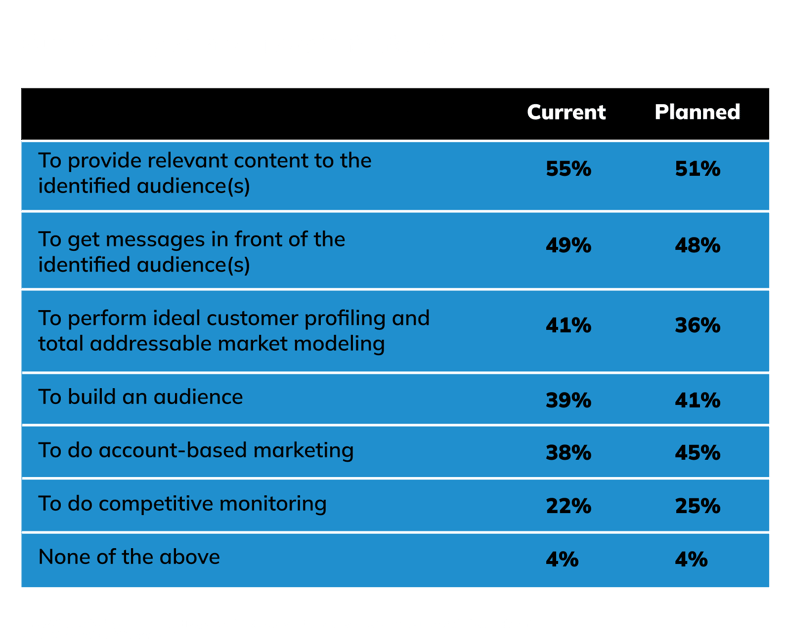

When we look at how these marketers are using intent data, we see that they’re using it mostly to provide relevant content to and get messages in front of identified audiences. These are also areas where most marketers are planning to increase their use of intent data.

Data Heroes are using intent data in these cases as well, but they’re also more likely to be using intent data for more advanced use cases like account-based marketing (ABM).

Data Heroes are 20% more likely to use intent to run ABM than their peers.

An area where we see low use—and room for growth—is competitive monitoring. Intent data is valuable in that it can play many roles in your funnel. According to our survey, most marketers are applying intent data in foundation-level uses but haven’t scaled their intent use to cover more advanced uses like ABM and competitive monitoring. Leveling up your intent data use to other applications is an opportunity to make your campaigns stronger and drive better results.

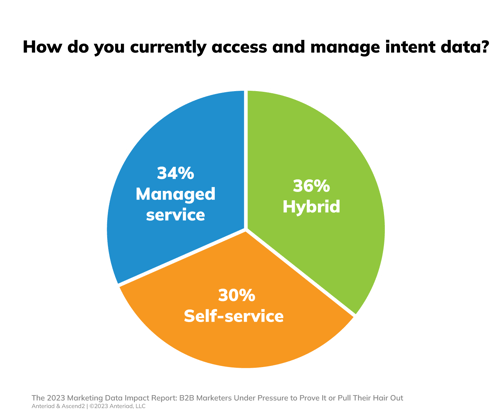

Access and management of intent data

About the same number of marketers use self-service and managed service intent data — but those that use a managed service are much more confident. By using a managed service, you can be certain you are getting the best use of the data because you have the expertise of a data partner behind you.

Confidence Booster.

Managed service users feel significantly more confident (70% are extremely confident) in their use of intent data than self-service users (26% extremely confident).

Next steps

Building, targeting, and converting audiences depends on having reliable data. Having accurate data and using different types of data to understand your audience, like intent data, gives you the path to your next sale.

In an economic climate when marketers are being pressed to prove their value, choosing a strategy to drive the most impact should be top of mind. The results of this report offer insight into where you can focus your efforts for the maximum opportunity to get results.

- Invest in Intent Data. Start using intent data, or if you are already using it, expand your use to leverage it in other areas of your sales funnel. Intent data users are more likely to meet their goals and feel more confident in their ability to show the value of their strategy. Use a managed service so you know you’re getting the most out of your intent data.

- Score by buying groups. Buyers don’t make decisions alone. By tracking the buying group you can get a better understanding of who is part of the buying decision and increase your conversions. We found that the marketers in our Growth Mode group are nearly 2x as likely to be using buying groups. Building buying groups into your scoring and targeting strategy can have a significant impact on your metrics.

- Get better data. All your marketing efforts are directly impacted by the data you use. Ensuring that you have high-quality and accurate data is vital. Take steps to make sure you have the best data possible. From auditing and cleaning up your first-party data to working with a certified partner to enhance your data strategy with deeper information you may not have access to, there are changes you can make to see quick results.

You can have this insightful report sent straight to your inbox.

Ascend2 benchmarks the performance of business strategies and the tactics and technology that drives them. Anteriad partnered with Ascend2 to survey 328 marketing decision-makers, senior management and above, located in the United States and the United Kingdom. These marketers represent B2B organizations with 250 or more employees targeting a variety of company sizes. The survey was fielded during the month of March 2023.