We’re diving deeper into some of the data from our recent State of Data and Technology in 2022 report through a three-part blog series, Breaking Down the Data. These insights will help you make data-driven decisions about the year ahead.

In this first installment, we’re looking at how money plays a part in the current marketing landscape. We’ll dig into two main components here: revenue and budgets.

Where Will Revenue Come From?

Driving revenue is essential to any successful business. It’s important to know where your revenue will come from so you can optimize your demand strategy. Our recent survey asked marketers to tell us how they expect to drive revenue in 2023.

Net new vs. upsell/cross-sell

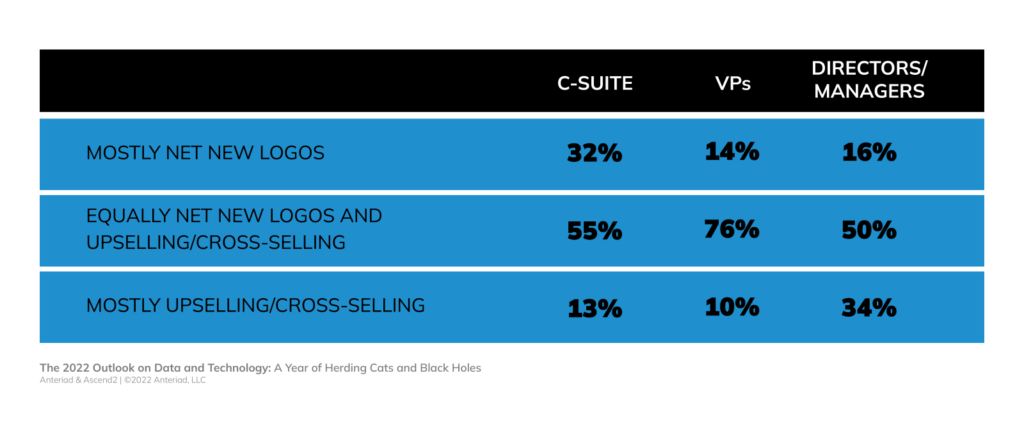

As a whole, more than half marketers expect to drive revenue from both net new logos and upsell/cross-sell opportunities equally.

But when we look closer at the data, a few key points stand out. Most notably, marketers at different career levels expect revenue to come from different places.

Nearly a third of the C-suite responded that they expect a focus on net-new logos, while only 13% expect revenue to come from existing customers.

At the VP level, most marketers (76%) expect a near-even split between the two.

The rest of the marketing team, the directors and managers, answered almost entirely the opposite of the C-suite—roughly one-third think they will get most of their revenue from upselling or cross-selling existing accounts.

The problem … and the solution

Why does this matter? Because your teams may not be aligned on how they expect to drive revenue in 2023. If directors are targeting existing accounts while executives expect new logos, there will be a point when the two sides realize they have different goals. And as we all know, that is not an ideal situation. Teams will scramble to reset their strategies mid-year, and more often than not, they’ll lose momentum in the process.

So how do you prevent this? Take steps to align with your team now so there won’t be any surprises when it’s time for reporting. Remember, 32% of top execs expect most of their revenue from new logos, while only 14% of VPs do. So be sure your C-suite is a part of the conversation.

How Will Budgets be Spent?

A focus on technology

Our data shows marketers are budgeting more for marketing and sales technology in 2023 than they did in the past. In fact, 28% of respondents expect a significant increase in technology investments next year while another 56% expect a moderate increase. Only 7% expect a decrease, and 8% predict that their tech budgets will stay flat.

Granted, these are predictions. Though marketers want increased investments in their technology, there is no guarantee that they’ll receive these funds. However, regardless of the end state, these responses tell us that marketers are focusing on the tools they use – and they want to assign their budgets accordingly.

Solving for complexity

It’s important that these increased budgets, and the changes that come with them, add clarity—not complexity.

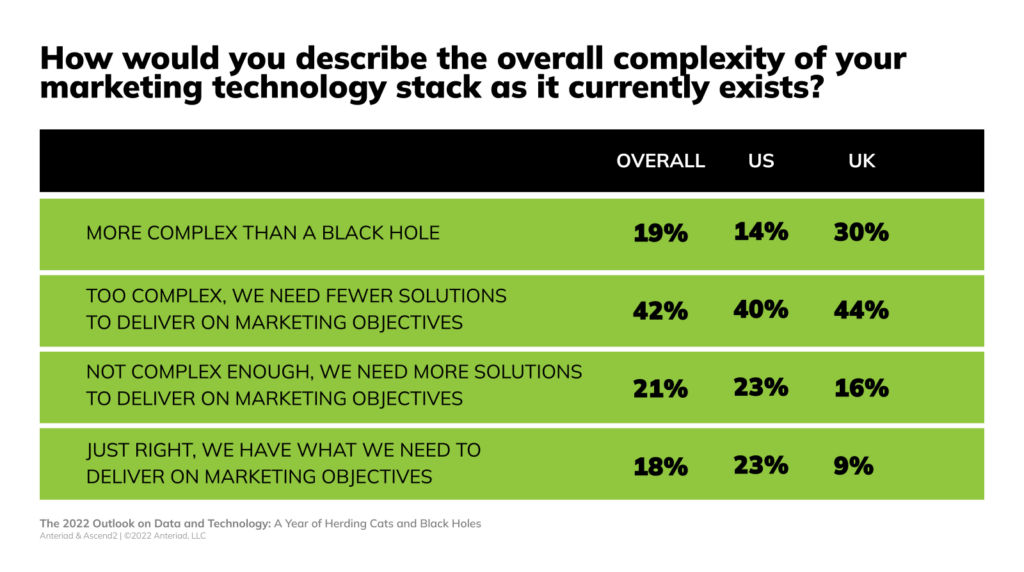

More than half of respondents said their martech stack was too complex— with 19% of those respondents saying it’s more complex than a black hole. And only 18% say it’s just right.

Here’s the good news: 93% of respondents believe that replacing, updating, or consolidating tools will solve their complexity issues.

This brings us back to budget allocation. While some teams may have in-house resources to consolidate tools, if you want to replace or update a system, you’ll generally need budget to make it happen. So in order to solve for complexity, teams will need the increased budgets they expect.

If you happen to need more persuading, here’s one more thing to consider: Companies that reported a 20% or more increase in revenue in the past year are also increasing their marketing and sales technology budgets. In fact, 64% of these companies said that they plan to significantly increase their investment in 2023.

What’s the takeaway? High-growth companies are spending money on martech; you should be too.

Take the Next Steps

With these insights in mind, we recommend two steps as you plan for the year ahead.

- Align with your full team about where your 2023 revenue will come from. We know that different job roles have different views on this matter, so be sure to include executives, VPs, directors, and managers in the same session.

- Create a prioritized wishlist for your martech stack. What are the biggest needs for your team? What actions can you take to reduce complexity across the board? You’ll want to be ready to use your budget (and to justify your ask for an increased budget) at the drop of a hat. The more prepared you are, the more you’ll set yourself up for success.

To learn more about what marketers did in 2022 – and what they plan to do in 2023 – read The 2022 Outlook on Data and Technology: A Year of Herding Cats and Black Holes. You can also learn more about the difference between US and UK responses in 2022 Marketing Trends: UK vs. US.

.png?width=290&name=MicrosoftTeams-image%20(26).png)